Cash Loans in Batesville, MS

At Family Financial Services Inc., we offer quick and easy loan approvals in just 1 hour, with amounts ranging from $500 to $15,000. With over 35 years of experience, our family-owned and operated business is dedicated to serving Batesville, Corinth, MS and everywhere in between.

Over 35 years

We have over three decades of experience, bringing extensive knowledge to meet your financial needs.

1-Hour Loan Approval

Our fast loan approval process ensures you get the funds you need quick.

Local, Family-Owned

As a local, family-owned business, we offer personalized service with a strong community connection.

Courteous Staff

Our professional and courteous staff are dedicated to providing exceptional customer service, ensuring you feel valued and respected.

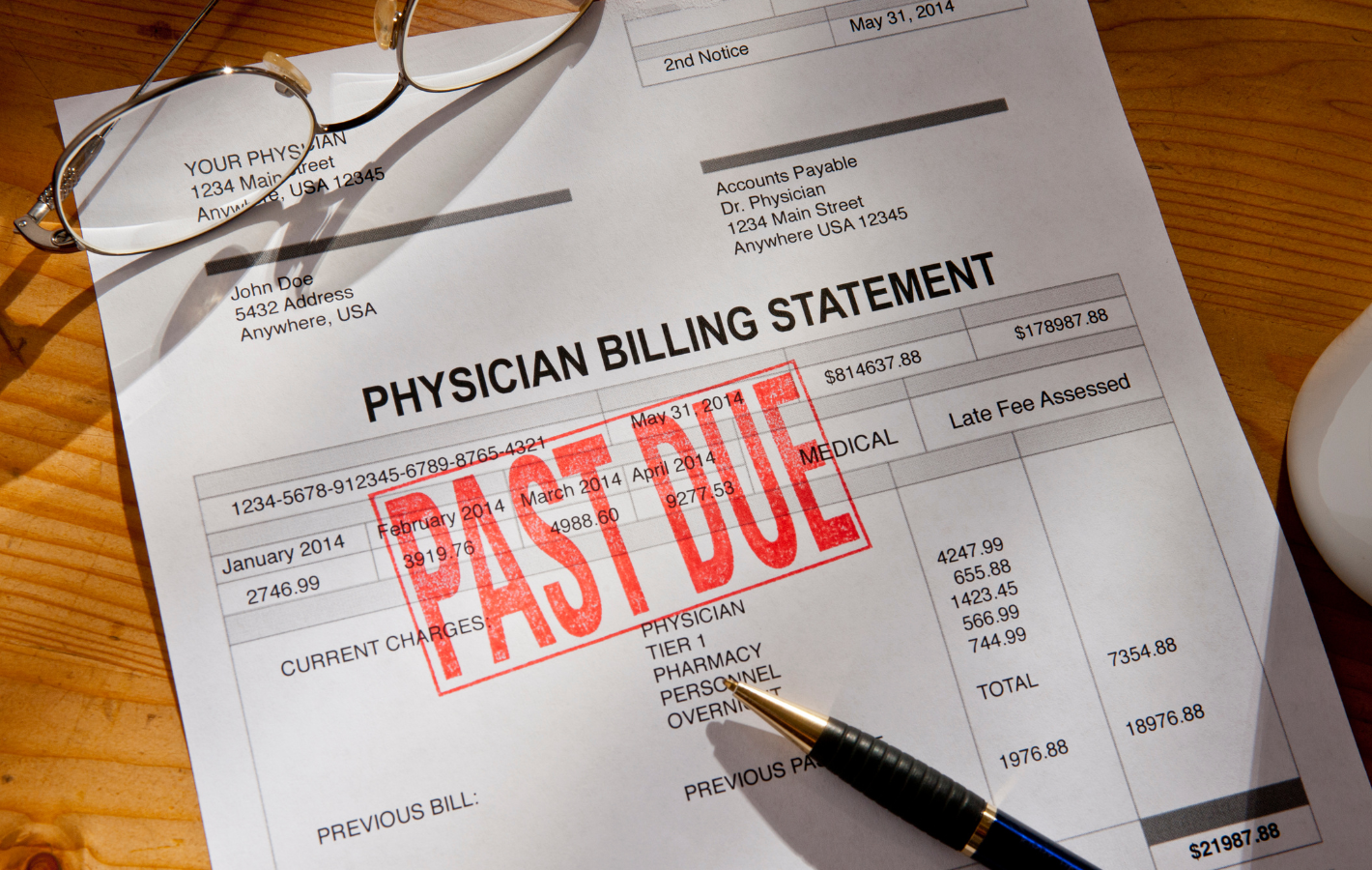

Unexpected medical expenses can place a significant financial burden on individuals and families. For residents of Batesville, Mississippi, using a personal loan to cover medical costs can provide much-needed relief and flexibility. Family Financial Loan Services offers a range of personal loan products designed to help you manage healthcare expenses effectively. This guide will provide tips on how to use a personal loan to cover medical expenses and ensure you make informed financial decisions. 1. Assess Your Medical Expenses Identify Your Medical Needs Determine the specific medical expenses you need to cover. These may include: Surgical Procedures: Costs associated with surgeries, including hospital stays and surgeon fees. Medical Treatments: Ongoing treatments for chronic conditions, such as chemotherapy or dialysis. Dental Work: Procedures such as braces, root canals, or dental implants. Vision Care: Costs for glasses, contact lenses, or corrective eye surgeries. Prescriptions: Expenses for medications not fully covered by insurance. Therapies: Physical therapy, occupational therapy, or mental health counseling. Calculate the Total Cost Sum up all your medical expenses to determine the total amount you need to borrow. Include any out-of-pocket costs, deductibles, and co-pays not covered by insurance. Review Your Insurance Coverage Before applying for a loan, review your health insurance policy to understand what is covered and what you will need to pay out-of-pocket. This will help you avoid borrowing more than necessary. 2. Explore Loan Options Types of Loans Available Different types of loans can be used to cover medical expenses. Understanding your options will help you choose the best loan for your needs: Personal Loans: Unsecured loans that can be used for various purposes, including medical expenses. Medical Loans: Specialized loans designed specifically for healthcare costs. Credit Cards: While not a loan, using a credit card for some medical expenses might be beneficial, especially if you have a card with low interest rates or a promotional period. Compare Loan Terms Research and compare loan terms from multiple lenders, including interest rates, repayment terms, and fees. Family Financial Loan Services in Batesville, MS, offers competitive rates and flexible terms for personal loans. Use Online Tools Utilize online loan calculators to estimate monthly payments, total interest, and overall loan costs based on different loan terms and interest rates. This will help you understand the financial implications of each loan option. 3. Check Your Credit Score Importance of Credit Score Your credit score significantly impacts your loan eligibility and the interest rate you’ll be offered. Higher credit scores generally lead to lower interest rates and better loan terms. Obtain Your Credit Report Get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Review your reports for accuracy and address any discrepancies. Improve Your Credit Score If your credit score is less than ideal, take steps to improve it before applying for a loan: Pay Down Existing Debts: Reducing your debt can improve your credit score and lower your debt-to-income ratio. Make Timely Payments: Consistently making on-time payments for your bills and existing loans can gradually improve your credit score. Avoid New Credit Inquiries: Multiple credit inquiries within a short period can negatively impact your credit score. 4. Get Pre-Approved Benefits of Pre-Approval Getting pre-approved for a loan provides a clear idea of how much you can borrow and the interest rate you’ll be offered. It also demonstrates to medical providers that you’re a serious payer with secure financing. Pre-Approval Process To get pre-approved, you’ll need to provide documentation such as proof of income, employment verification, and credit history. Family Financial Loan Services can guide you through the pre-approval process, ensuring you have all the necessary paperwork and information. 5. Apply for the Loan Complete the Application Fill out the loan application accurately and completely. Provide all requested information and double-check for errors. Incomplete or inaccurate applications can delay the approval process or result in denial. Submit Supporting Documents Submit all required supporting documents along with your application. Ensure that all documents are up-to-date and legible. Review the Loan Agreement Carefully review the loan agreement before signing. Ensure you understand all terms and conditions, including the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. 6. Manage Your Loan and Medical Expenses Set Up Automatic Payments Consider setting up automatic payments from your bank account to ensure you never miss a due date. This can help you avoid late fees and maintain a positive payment history. Track Your Spending Keep track of your spending to ensure you stay within your budget and can comfortably make your loan payments. Use financial tools and apps to monitor your expenses and manage your budget effectively. Build an Emergency Fund Having an emergency fund can provide a financial cushion in case of unexpected expenses. Aim to save at least three to six months’ worth of living expenses to protect yourself against financial setbacks. Communicate with Your Lender If you encounter any financial difficulties or have questions about your loan, communicate with your lender as soon as possible. Family Financial Loan Services is committed to supporting borrowers and may offer solutions such as payment extensions or modified repayment plans. 7. Explore Additional Resources Medical Payment Plans Many medical providers offer payment plans that allow you to spread out the cost of your medical expenses over time. Ask your healthcare provider if they have any financing options available. Health Savings Accounts (HSAs) If you have a Health Savings Account (HSA), you can use the funds to pay for qualified medical expenses. HSAs offer tax advantages, as contributions are tax-deductible, and withdrawals for medical expenses are tax-free. Nonprofit Organizations Some nonprofit organizations provide financial assistance for medical expenses. Research local and national organizations that may offer grants or aid for your specific medical needs. Conclusion Using a personal loan to cover medical expenses in Batesville, Mississippi, can provide financial relief and flexibility during a challenging time. By assessing your medical expenses, exploring loan options, checking your credit score, getting pre-approved, and managing your loan responsibly, you can make informed financial decisions and ensure you receive the necessary medical care. Family Financial Loan Services offers a variety of loan products and personalized support to help you navigate the borrowing process. Contact them today to learn more about their loan options and how they can assist you in financing your medical expenses. With the right approach and resources, you can manage your healthcare costs effectively and maintain your financial stability.

Taking a dream vacation can be a once-in-a-lifetime experience, but it often comes with a significant price tag. If you’re looking to finance your trip, a personal loan can provide the funds you need without straining your budget. For residents of Batesville, Mississippi, Family Financial Loan Services offers various loan products to help make your dream vacation a reality. This guide will walk you through the process of financing your dream vacation with a loan, from planning your budget to managing your repayments. 1. Plan Your Vacation Budget Define Your Dream Vacation Identify the destination, duration, and activities for your dream vacation. This will help you create a detailed budget and understand the total cost. Estimate Costs Consider all possible expenses, including: Flights: Airfare to and from your destination. Accommodation: Hotels, resorts, or vacation rentals. Transportation: Car rentals, public transportation, or rideshares. Food and Dining: Meals, snacks, and beverages. Activities and Excursions: Tours, attractions, and entertainment. Travel Insurance: Coverage for medical emergencies, trip cancellations, and lost luggage. Miscellaneous Expenses: Souvenirs, tips, and other incidentals. Create a Detailed Budget Sum up all estimated costs to determine the total amount you need for your vacation. Break down the budget into categories to get a clear picture of your expenses. 2. Explore Loan Options Types of Loans Available Different types of loans can be used to finance your vacation. Understanding your options will help you choose the best loan for your needs: Personal Loans: Unsecured loans that can be used for various purposes, including travel. Travel Loans: Specialized loans designed specifically for financing vacations. Credit Cards: While not a loan, using a credit card for some expenses might be beneficial, especially if you earn travel rewards or cashback. Compare Loan Terms Research and compare loan terms from multiple lenders, including interest rates, repayment terms, and fees. Family Financial Loan Services in Batesville, MS, offers competitive rates and flexible terms for personal loans. Use Online Tools Utilize online loan calculators to estimate monthly payments, total interest, and overall loan costs based on different loan terms and interest rates. This will help you understand the financial implications of each loan option. 3. Check Your Credit Score Importance of Credit Score Your credit score significantly impacts your loan eligibility and the interest rate you’ll be offered. Higher credit scores generally lead to lower interest rates and better loan terms. Obtain Your Credit Report Get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) through AnnualCreditReport.com. Review your reports for accuracy and address any discrepancies. Improve Your Credit Score If your credit score is less than ideal, take steps to improve it before applying for a loan: Pay Down Existing Debts: Reducing your debt can improve your credit score and lower your debt-to-income ratio. Make Timely Payments: Consistently making on-time payments for your bills and existing loans can gradually improve your credit score. Avoid New Credit Inquiries: Multiple credit inquiries within a short period can negatively impact your credit score. 4. Get Pre-Approved Benefits of Pre-Approval Getting pre-approved for a loan provides a clear idea of how much you can borrow and the interest rate you’ll be offered. It also demonstrates to travel agents or vendors that you’re a serious buyer with secure financing. Pre-Approval Process To get pre-approved, you’ll need to provide documentation such as proof of income, employment verification, and credit history. Family Financial Loan Services can guide you through the pre-approval process, ensuring you have all the necessary paperwork and information. 5. Apply for the Loan Complete the Application Fill out the loan application accurately and completely. Provide all requested information and double-check for errors. Incomplete or inaccurate applications can delay the approval process or result in denial. Submit Supporting Documents Submit all required supporting documents along with your application. Ensure that all documents are up-to-date and legible. Review the Loan Agreement Carefully review the loan agreement before signing. Ensure you understand all terms and conditions, including the interest rate, repayment schedule, fees, and any penalties for late payments or early repayment. 6. Manage Your Loan and Vacation Expenses Set Up Automatic Payments Consider setting up automatic payments from your bank account to ensure you never miss a due date. This can help you avoid late fees and maintain a positive payment history. Track Your Spending Keep track of your spending to ensure you stay within your budget and can comfortably make your loan payments. Use financial tools and apps to monitor your expenses and manage your budget effectively. Build an Emergency Fund Having an emergency fund can provide a financial cushion in case of unexpected expenses during your vacation. Aim to save at least three to six months’ worth of living expenses to protect yourself against financial setbacks. Communicate with Your Lender If you encounter any financial difficulties or have questions about your loan, communicate with your lender as soon as possible. Family Financial Loan Services is committed to supporting borrowers and may offer solutions such as payment extensions or modified repayment plans. 7. Enjoy Your Vacation Responsibly Stick to Your Budget Adhering to your budget is crucial for the successful completion of your vacation without incurring additional debt. Monitor your expenses closely and avoid unnecessary spending. Use Credit Wisely If you use a credit card during your trip, ensure you can pay off the balance promptly to avoid high-interest charges. Take advantage of any travel rewards or cashback offers that can help offset your vacation costs. Plan for the Future After returning from your vacation, review your financial situation and adjust your budget as needed. Reflect on your spending habits and plan for future vacations with the knowledge and experience gained. Conclusion Financing your dream vacation with a loan in Batesville, Mississippi, requires careful planning and strategic decision-making. By defining your vacation budget, exploring loan options, checking your credit score, getting pre-approved, and managing your loan responsibly, you can make informed choices and enjoy your trip without financial stress. Family Financial Loan Services offers a variety of loan products and personalized support to help you navigate the borrowing process. Contact them today to learn more about their loan options and how they can assist you in financing your dream vacation. With the right approach and resources, you can make your dream vacation a reality and create lasting memories without compromising your financial stability.

Starting or expanding a business often requires significant capital, and securing a business loan can provide the necessary funds to achieve your goals. For business owners in Batesville, Mississippi, understanding the various loan options and how to qualify for them is crucial. Family Financial Loan Services offers a range of business loan products designed to meet diverse financial needs. This guide will explore the different types of business loans available, the benefits of each, and tips for applying successfully. Types of Business Loans 1. Term Loans Overview Term loans are a common type of business financing where you receive a lump sum of money upfront and repay it with interest over a set period. These loans can be used for various purposes, such as purchasing equipment, expanding operations, or managing working capital. Benefits Fixed Repayment Schedule: Predictable monthly payments make budgeting easier. Flexible Use of Funds: Funds can be used for a wide range of business needs. Lower Interest Rates: Typically offer lower interest rates compared to credit cards or lines of credit. 2. Small Business Administration (SBA) Loans Overview SBA loans are partially guaranteed by the U.S. Small Business Administration, reducing the risk for lenders and making it easier for small businesses to qualify. These loans often have favorable terms and lower interest rates. Benefits Lower Interest Rates: SBA loans usually offer competitive interest rates. Longer Repayment Terms: Extended repayment periods can reduce monthly payment amounts. Higher Loan Amounts: Businesses can access substantial funding for large projects or expansions. 3. Business Lines of Credit Overview A business line of credit provides access to a set amount of funds that you can draw from as needed. Interest is only charged on the amount you use, making it a flexible financing option for managing cash flow. Benefits Flexibility: Use funds as needed and pay interest only on the amount borrowed. Revolving Credit: As you repay the borrowed amount, the credit becomes available again. Quick Access to Funds: Ideal for covering unexpected expenses or opportunities. 4. Equipment Financing Overview Equipment financing is specifically designed to help businesses purchase necessary equipment. The equipment itself serves as collateral, which can make it easier to qualify and secure favorable terms. Benefits Secured Loan: The equipment serves as collateral, reducing the lender's risk. Preserve Cash Flow: Spread the cost of expensive equipment over time. Tax Benefits: Potential tax advantages for purchasing business equipment. 5. Invoice Financing Overview Invoice financing allows businesses to borrow against their outstanding invoices. This type of financing is useful for improving cash flow and managing operations while waiting for clients to pay. Benefits Improve Cash Flow: Access funds tied up in unpaid invoices. Flexible Financing: Funds can be used for various business needs. No Additional Debt: Financing is based on your accounts receivable, not a new loan. Benefits of Business Loans 1. Access to Capital Business loans provide the necessary funds to start, grow, or maintain operations. This access to capital can help businesses seize opportunities, manage cash flow, and invest in growth. 2. Build Business Credit Successfully managing a business loan can help build your business credit profile. This can make it easier to qualify for future financing and secure better terms. 3. Maintain Ownership Unlike equity financing, business loans do not require you to give up ownership or control of your business. You retain full control while accessing the necessary funds. 4. Tax Benefits Interest paid on business loans is often tax-deductible, reducing your overall tax liability and providing additional financial benefits. Tips for Applying for a Business Loan 1. Assess Your Business Needs Determine Loan Purpose Clearly define why you need the loan and how you plan to use the funds. Common reasons include expanding operations, purchasing equipment, managing cash flow, and funding new projects. Calculate Loan Amount Determine the exact amount you need to borrow. Avoid over-borrowing to prevent unnecessary debt and higher interest costs. 2. Check Your Credit Score Personal and Business Credit Lenders will consider both your personal and business credit scores when evaluating your loan application. Obtain a copy of your credit reports and review them for accuracy. Improve Your Credit Score If your credit score is less than ideal, take steps to improve it before applying for a loan. This includes paying down existing debts, making timely payments, and addressing any inaccuracies on your credit reports. 3. Prepare Financial Documents Required Documentation Gather the necessary financial documents to support your loan application. Commonly required documents include: Business Plan: A detailed plan outlining your business goals, strategies, and financial projections. Financial Statements: Income statements, balance sheets, and cash flow statements. Tax Returns: Personal and business tax returns for the past few years. Bank Statements: Recent bank statements for both personal and business accounts. 4. Research Lenders Compare Loan Options Research and compare loan options from multiple lenders, including banks, credit unions, and online lenders. Consider factors such as interest rates, repayment terms, fees, and customer reviews. Family Financial Loan Services Family Financial Loan Services in Batesville, MS, offers competitive rates and personalized service for various business loan products. Contact them to discuss your financing needs and explore their loan options. 5. Submit a Strong Loan Application Complete the Application Fill out the loan application accurately and completely. Provide all requested information and double-check for errors. Provide Supporting Documents Submit all required supporting documents along with your application. Ensure that all documents are up-to-date and legible. 6. Review Loan Offers Compare Terms and Conditions Carefully review the terms and conditions of each loan offer. Pay attention to the interest rate, repayment schedule, fees, and any prepayment penalties. Choose the Best Offer Select the loan offer that best meets your business needs and provides the most favorable terms. 7. Manage Your Loan Responsibly Set Up Automatic Payments Consider setting up automatic payments to ensure you never miss a due date. This can help you avoid late fees and maintain a positive payment history. Track Your Loan Keep track of your loan balance, payment schedule, and interest rate. Regularly review your loan statements to ensure all payments are correctly applied. Communicate with Your Lender If you encounter any financial difficulties or have questions about your loan, communicate with your lender as soon as possible. Family Financial Loan Services is committed to supporting borrowers and may offer solutions such as payment extensions or modified repayment plans. Conclusion Exploring business loan opportunities in Batesville, Mississippi, involves understanding the different types of loans available, their benefits, and the application process. By assessing your business needs, checking your credit score, preparing financial documents, researching lenders, and submitting a strong application, you can increase your chances of securing the necessary funds to achieve your business goals. Family Financial Loan Services offers a range of business loan products and personalized support to help you navigate the borrowing process. Contact them today to learn more about their loan options and how they can assist you in securing the financing you need to grow your business. With the right approach and resources, you can make informed decisions and enjoy the benefits of sound financial planning for your business.